Our investment process consists of 5 steps:

1. Defining the investment universe

Our investment universe includes all publicly tradable stocks in the world. We are excluding IPO's and stocks that have been previously held by Private Equity.

2. Idea generation

We are conducting stock selection based on fundamental analysis. The selection and investment ideas are generated by a well established research network and a pool of more than 2000 financial models that have been added to our database over the years. The database is regularly screened for undervalued stocks.

3. Company analysis

The company analysis consists of two parts that are intertwined with each other: a fundamental, economic analysis to determine the value of the company and a qualitative assessment of the business quality. We determine the company value based on discounted cash flows, net asset values, and valuation ratios while using qualitative insights to make reasonable assumptions. The most important factors for us include: Competitive position, management culture, price sensitivity of products, balance sheet quality, industry attractiveness, barriers to entry, liquidity requirements and ownership structure.

4. Portfolio construction

The portfolio construction is mainly based on the discount to intrinsic value of the portfolio companies. At the same time we diversify the portfolio from an economic perspective to avoid overweighting certain industries.

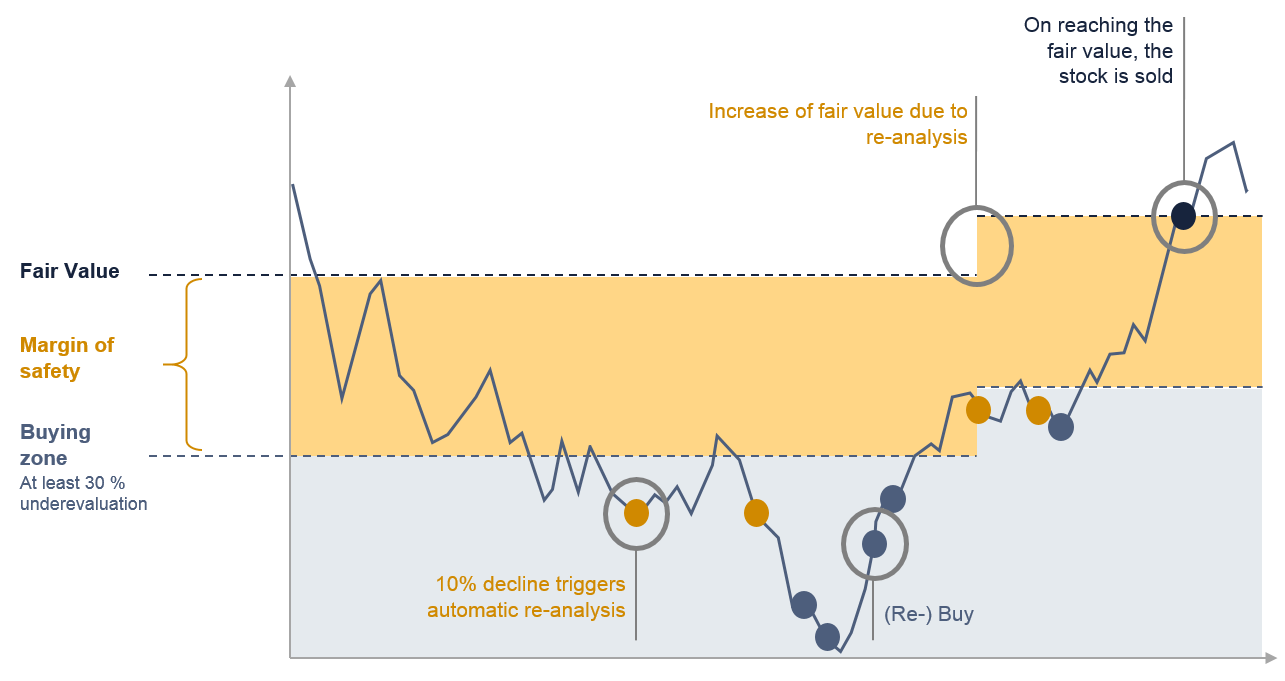

5. Monitoring

The portfolio is evaluated daily according to the LOYS criteria. If a company reaches an appropriate valuation level it is sold. At the same time we monitor and re-evaluate current investments especially in the case of price anomalies, business relevant news or when quarterly and annual reports are published.